Running a structured process maximises results

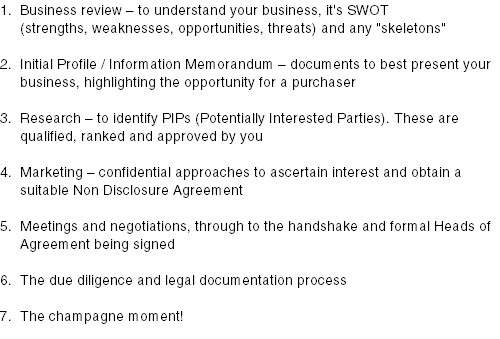

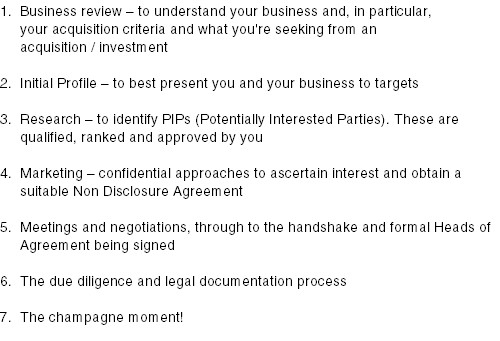

So where does this complex process start and how do we reach the outcome you want? The Mercury team is absolutely focused on optimising the result for you and minimising the fuss. We know from experience that the best way to achieve this is to run a structured "process". By following this process we can maximise your result, whilst you retain control throughout each stage. The process can be broken down into 7 stages. If you're a potential seller or a buyer:

-

SALE OF A COMPANY OR BUSINESS

-

MERGER / ACQUISITION OR INVESTMENT INTO A COMPANY OR BUSINESS

WHAT CAN GO WRONG?

Mergers and acquisitions are a long process and require a great deal of planning. Mercury are different, in that they have a vast amount of experience, we anticipate problems and know how to combat most situations. Below are typical examples of some issues and the solutions Mercury applies.

EXAMPLE 1

ISSUE: PIP or Target are time-wasters, only interested in finding out commercially-sensitive information about your business.

MERCURY SOLUTION: Manage the process firmly, setting time-related targets at each stage, and limit the release of sensitive information.

EXAMPLE 2

ISSUE: After agreement is reached, the purchaser seeks to re-negotiate.

MERCURY SOLUTION: Anticipate! The Information Memorandum should contain all relevant information to reduce the risk of "goal-post moving" and the process is run to minimise this risk.

EXAMPLE 3

ISSUE: Target declines to release information necessary to support an offer.

MERCURY SOLUTION: Appreciate that this is a new experience for the Target and "hand hold" them - explain what is required and build in staged safeguards to protect them.

REQUEST A CALLBACK

To discuss a free valuationin more detail please submit

our call back request below.

" The sale of a company or business is likely to be the most significant and valuable transaction that any entrepreneur, manager or investor will ever contemplate."